Manufacturers of consumer packaged goods (CPG) face two key challenges in 2015. The first is continued slow or negative growth in people’s disposable incomes. The second is changing consumer attitudes toward products and brands, as the the great fragmentation of consumer markets takes another turn. In response, companies must dramatically shift the route they take to reach consumers in terms of both product distribution and communications.

In many markets, consumer wages have been static for five years. Even where economies are starting to perform better, the squeeze on after-tax wages, especially for the middle class, younger people, and families, is depressing consumer spending. Although growth in developing countries is still better than in the United States and Europe, a slowdown in emerging countries such as China — where many companies had hoped for higher sales — has translated quickly into lower-than-expected consumer spending growth. We expect continued weakness in consumer disposable income regardless of which way macro GNP uncertainties break.

Meanwhile, what we call the great fragmentation is manifested in consumer behavior and market response. In both developed and emerging markets, there is a wider variety among consumers now than at any time in the recent past. Growth is evident both at the top of the market (where more consumers are spending for higher-quality food and other packaged goods) and at the lower end (where an increasing number of consumers are concentrating on value). But the traditional middle of the market is shrinking.

The capabilities scorecard

To thrive in the leaner and more fragmented marketplace of the future, CPG companies should focus on seven key capabilities:

- Building a comprehensive data set of sources on consumer, brand, product, and competitive behavior

- Developing analytical skills, tools, and routines that use the data in the ways that are critical for the specific business

- Translating those insights into actions at the product, brand, and retail level

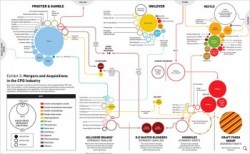

- Planning the portfolio of brands and products to efficiently cover full market variety and using this as a lens for M&A plans

- Managing the expanding portfolio of retail channels to provide the right incentives, reflecting differences by channel in how consumers and retailers interact

- Managing the interactions between the retail channels

- Managing complexity rather than merely trying to minimize it

By concentrating on these key capabilities and combining them in a coherent fashion, CPG companies can increase their returns on investment and position themselves to outperform their peers in the leaner and more fragmented marketplace of the future.

Meanwhile, what we call the great fragmentation is manifested in consumer behavior and market response. In both developed and emerging markets, there is a wider variety among consumers now than at any time in the recent past. Growth is evident both at the top of the market (where more consumers are spending for higher-quality food and other packaged goods) and at the lower end (where an increasing number of consumers are concentrating on value). But the traditional middle of the market is shrinking.

Author: K. B. Shriram